A big focus of our climate movement is the shift from fossil fuels to fair, safe and climate-friendly renewable energy sources like solar, wind and even geothermal power. Yet, driving this ambitious transition forward lies a crucial force: money or finance. Or what we refer to as climate finance.

But what exactly is climate finance, and why is it so important for a just energy transition? We are answering all your burning questions on climate finance – so let’s start with the basics:

What is Climate Finance?

Climate finance are the money flows supporting all actions that safeguard our planet’s future. While there’s no single definition of climate finance, the United Nations Framework Convention on Climate Change (UNFCCC), an international treaty among countries, offers a widely accepted one: it is financing, whether local, national, or transnational, aimed at supporting actions to mitigate and adapt to climate change.

Where does climate finance come from?

Climate finance money comes from various sources with some of the main ones underlined below :

Public Funds

Public funds for climate initiatives come from government budgets, which allocate money collected from taxes. These funds are used for various climate-related projects, such as grants, subsidies, and direct funding. For example, the Green Climate Fund (GCF) receives contributions from countries like the United States, Germany, and Japan. This money is used to finance projects in developing nations, such as building resilient infrastructure or supporting sustainable agriculture to combat climate change.

Development Banks

Development banks, such as the World Bank and the Asian Development Bank (ADB), provide financing specifically for climate-related projects. They offer low-interest loans, grants, and technical assistance for large-scale infrastructure and development efforts. For instance, these banks finance renewable energy infrastructure projects, like wind farms in India or solar power plants in Thailand. The capital for these banks comes from member countries, including both public and private contributions, as well as financial markets.

Private Sector Investments

Companies in the private sector invest in green technologies and sustainable practices, driven by business strategies and corporate social responsibility. These investments include direct funding for projects, venture capital for green startups, and corporate bonds. Ironically and unfortunately, a lot of the same companies that are responsible for the climate crises (and fossil fuels) are some of the major investors in the green energy space. For instance, Amazon is one of the world’s largest corporate investors of renewable energy, purchasing more than 100 new solar and wind energy projects in 2023. Tesla invests in electric vehicle production and battery technology, while Google funds renewable energy projects, such as wind and solar farms, to power its data centers. Google’s philanthropic arm, Google.org, has invested in renewable energy projects to benefit underserved communities. For example, Google.org provided $2.75 million in grants to support renewable energy projects in Sub-Saharan Africa, focusing on bringing clean energy to schools, health clinics, and homes. Such investments are financed through company profits, capital markets, and private company investors.

Philanthropic Contributions

These come from foundations and charitable organizations that fund climate research, innovation, and advocacy efforts. This funding takes the form of grants, donations, and endowments. For instance, the Bill & Melinda Gates Foundation supports research on sustainable agriculture practices and innovations in renewable energy technologies to address climate change impacts. The money for these contributions comes from private donations, endowments, and fundraising activities.

By leveraging a combination of public funds, development bank financing, private sector investments, and philanthropic contributions, comprehensive and sustainable climate solutions can be effectively implemented. Each source of funding plays a crucial role in mobilizing resources to address climate change on a global scale.

Where does climate finance go?

Climate finance serves three main purposes:

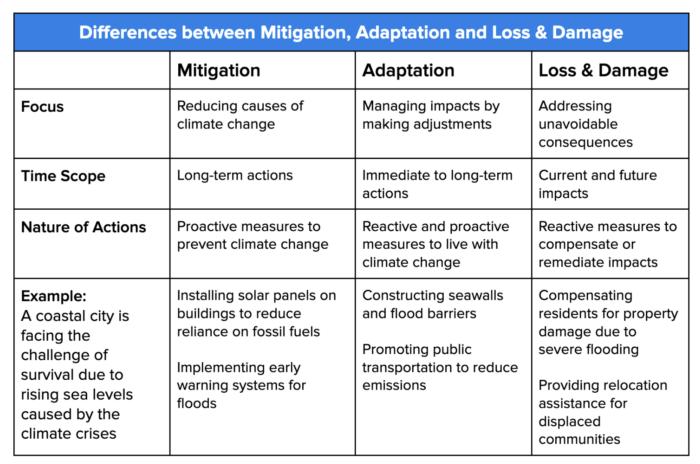

1. Mitigation

These are efforts to reduce air pollution or the flow of heat-trapping greenhouse gasses into the atmosphere that contribute to the climate crisis so we can keep global heating to a minimum.

Objective: To reduce greenhouse gasses, and limit global heating.

Examples:

- Switching to renewable energy sources (e.g., solar, wind).

- Implementing reforestation projects to absorb CO2 and restore ecosystems.

- Promoting electric vehicles to decrease emissions from transportation.

- Installing large-scale solar farms to reduce reliance on fossil fuels.

We measure progress on climate mitigation through two global climate goals: Limiting global heating to 1.5 degree celsius to prevent irreversible climate damage. And to do that, we need to reach net-zero, which means we do not add any additional carbon into the atmosphere:

2. Adaptation

These are changes made in natural or human systems to cope with actual or expected climate changes, reducing harm or taking advantage of new opportunities.

Objective: To reduce vulnerability and enhance resilience to the impacts of climate change.

Examples:

- Planting drought-resistant crops to ensure food security in arid regions.

- Building green roofs in urban areas to reduce heat island effects and manage stormwater.

- Constructing flood barriers to protect coastal communities from rising sea levels

At the moment, several small island nations are facing threats to their survival from climate impacts, like rising sea levels. Adaptation measures, such as resilient infrastructure and early warning systems, are crucial to protect lives. While certain nations have an urgency to act now, the use of fossil fuels is inextricably directly linked to each person’s well-being. Learn more about the impacts of fossil fuels on us.

3. Loss and Damage

This refers to the money that goes into surviving against the impacts of climate change that cannot be avoided through mitigation or adaptation efforts,

Objective: To address and support those suffering from the unavoidable impacts of climate change.

Examples:

- Economic losses due to property damage from extreme weather events.

- Non-economic losses such as loss of biodiversity, cultural heritage, and human lives.

- Island nations losing land to sea-level rise.

- Communities displaced by severe climate events.

What is an example of climate financing in action?

Scenario: Imagine a remote village without reliable electricity, reliant on polluting sources like kerosene lamps. This community faces health risks from indoor air pollution and economic burdens due to the high cost of kerosene. Recognizing the need for a sustainable solution, a local NGO collaborates with an international development agency to secure climate finance.

Assembling climate finance: The funding comes from a combination of sources. An international development agency provides a grant to cover the initial costs of the project, including equipment and installation. A philanthropic foundation contributes additional funds to support training and maintenance, ensuring the community can manage the system independently. An impact investor offers a low-interest loan to bridge any financial gaps, with the expectation of modest returns through energy sales to the villagers.

Putting climate finance to use:With these funds, the NGO initiates the project, involving extensive community consultations and volunteer participation. Through collaborative efforts with local residents, the NGO establishes a solar microgrid system in the village ensuring that local needs and perspectives are fully integrated into the project’s design and implementation. The solar microgrid system collects energy from the sun to power homes and businesses in the village.

Benefits: The project not only provides clean, reliable electricity but also replaces the need for kerosene lamps, significantly reducing greenhouse gas emissions. This shift contributes to global mitigation efforts by cutting the community’s carbon footprint. Additionally, the solar microgrid enhances the village’s resilience to energy insecurity, a crucial aspect of climate adaptation. Reliable electricity supports better healthcare, education, and economic opportunities, improving overall quality of life.

While the primary focus is on mitigation, the project indirectly addresses loss and damage. By preventing health issues related to kerosene use and reducing the economic strain on households, the village avoids long-term costs associated with healthcare and environmental degradation.

Learning: In this way, climate finance from diverse sources enables the village to transition to sustainable energy, showcasing the powerful impact of coordinated financial support in fostering resilient and eco-friendly communities.

Conclusion

However, in reality, many such small-scale and large-scale projects across nations, particularly developing nations or the so called ‘Global South’ need to be urgently sponsored. As electricity consumption (and subsequent carbon pollution) in developing economies is set to grow around three times the rate of advanced economies, we need to urgently invest in renewable energy sources (while divesting from fossil fuels) to put countries on a pathway towards net-zero emissions.

In the next part of this series, we will see how our leaders and international institutions are coming together to ensure there is a sufficient flow of climate finance for mitigation, adaptation and loss & damage projects around the world.

The post ClimateCash Series (I) : What is Climate Finance appeared first on 350.

3 months ago

57

3 months ago

57