Over the past year, we’ve seen significant momentum toward an era of zero-emission trucks and buses. Perhaps most notable were California’s adoption of the world’s first economy-wide zero emission truck and bus fleet standard and the first nationwide purchase incentives for zero-emission medium- and heavy-duty vehicles in the Inflation Reduction Act (IRA). While both actions will stimulate the market for zero-emission medium- and heavy-duty vehicles and lead to accelerated adoption, much more work needs to be done to get us on track to a more equitable zero-emission future.

The Environmental Protection Agency (EPA) is currently developing a regulation to reduce climate-warming greenhouse gas emissions (GHG) from trucks, known as the Phase 3 GHG standards, which would in theory result in increased adoption of electric trucks. While this represents a huge opportunity to accelerate the adoption of zero-emission trucks, as my colleague Dave Cooke pointed out, the proposed standards would fail to even keep pace with electric truck adoption projections—never mind accelerate it.

There are many reasons EPA should pursue a much stronger standard than what they’ve proposed—first and foremost being the outsized impact trucks have on air quality and climate change. Additionally, the economics, growth in availability, and future markets for electric trucks all point in the right direction.

Zero-emission trucks and buses are reaching upfront cost parity

Price is often seen as a primary barrier to the adoption of zero-emission vehicles, as electric models often have a higher sticker price than combustion models. Retail prices for electric trucks and buses are declining and this trend is projected to continue. Despite this, and the significantly lower fuel and maintenance expenses of electric trucks, upfront price can still be a barrier. Thankfully, the up-to-$40,000 purchase incentive for commercial clean vehicles in the IRA helps to bridge this gap and will stimulate the market, which will in turn accelerate price parity. Notably, draft guidance recently released by the Internal Revenue Service (IRS) confirms that tax-exempt entities, including cities, could be eligible for this and certain other IRA incentives.

Studies examining the current and future market for zero emission medium- and heavy-duty vehicles have been published since the IRA’s passage last year and are showing promising results. Research published by The International Council on Clean Transportation (ICCT) earlier this year suggests that electric trucks and buses in most weight classes will reach upfront price parity before the end of the decade. Another study by BloombergNEF looked at total-cost of ownership (including upfront and ongoing costs like fuel and maintenance) and found that even the more expensive electric tractor trucks would achieve total-cost parity by 2030.

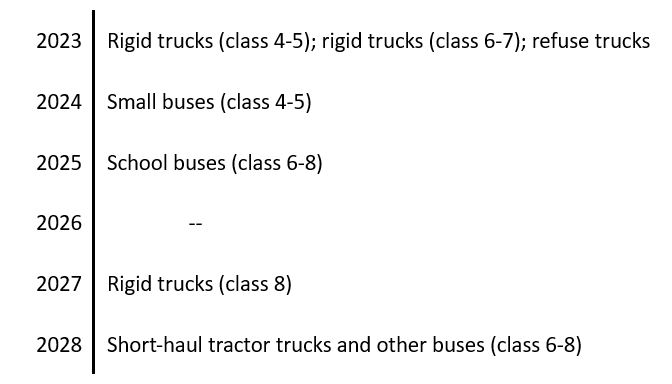

Timeline of Anticipated Retail Price Parity Between Heavy Duty Battery Electric Vehicles and Internal Combustion Engine Vehicles

Estimates are based on tax credits for qualified commercial vehicles under the IRA. Adapted from Table A2 in ICCT’s January 2023 study mentioned above.

The availability of electric trucks and buses continues to grow

The number of electric trucks and buses on the market has increased substantially over the past few years. Today, there are zero-emission medium- and heavy-duty vehicles available in every weight class and for most uses—from tractor trucks to coach buses. In the U.S. and Canada, more than 180 models of these vehicles are available, according to CALSTART’s Zero-Emission Technology Inventory. If you throw transit buses into the mix, the number jumps to over 200.

While this growth is meaningful, about a 30% increase in availability in just 3 model years, the market here in North America significantly trails that of China, where more than 260 models are available. The good news on this front is that California’s Advanced Clean Trucks (ACT) rule, which requires manufacturers to produce and sell an increasing amount of zero emission medium- and heavy-duty vehicles, is fully set to kick in next year. This will help to accelerate the availability and deployment of electric trucks and buses. So far, eight states (Colorado, Massachusetts, New Jersey, New York, Oregon, Rhode Island, Vermont, and Washington) have joined California in adopting the ACT, representing about 20% of the national market. Several others, including Maryland, are anticipated to adopt the rule in the coming months.

In the absence of a strong federal standard, the continued expansion of ACT is foundational to growing the market for zero emission medium- and heavy-duty vehicles.

Current market projections outpace EPA’s proposal

Both the positive economics and state regulations like ACT are pushing the market for electric trucks forward. Although electric trucks and buses are a small fraction of the total medium- and heavy-duty vehicles sold today, recent studies suggest significant market growth through the end of the decade.

The ICCT study I mentioned above projects significant growth in battery-electric truck and bus sales across the board, even in a moderate adoption scenario. In a few select cases, like box trucks and trash collectors, battery-electric models are anticipated to outpace diesel models by the end of the decade. This is driven by positive economics, incentives, and regulations like ACT. Each of these also creates additional market certainty, which accelerates technology development and infrastructure deployment.

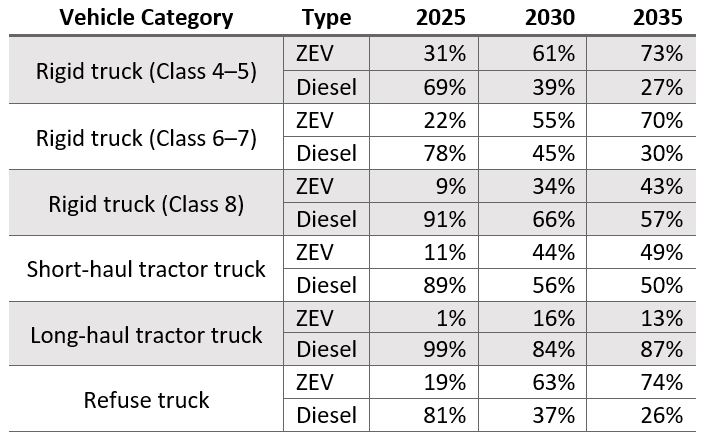

Projected National Market Share of Heavy Duty Zero-Emission Vehicles and Diesel Vehicles

Table adapted from Table A3 in ICCT’s January 2023 study mentioned above. Rounding may cause percentages to not add to 100%. Zero-emission vehicles include both battery-electric and hydrogen fuel cell vehicles.

However, ICCT projections for some of the most polluting trucks, particularly long-haul tractor trucks, show that much more work is needed. Electrifying tractor trucks is essential to affecting equitable access to clean air given that tractor trucks make up the largest share of air pollution from medium- and heavy-duty vehicles, especially in port and freight-adjacent neighborhoods. California’s recently passed Advanced Clean Fleets (ACF) standard, which requires the state’s largest truck fleets and all trucks carrying containers from ports to transition to zero-emission vehicles over time, is a huge step in the right direction, but nationwide action is necessary to affect a meaningful transition.

As I mentioned before, in nearly every case, market projections for zero emission medium- and heavy-duty vehicles sales far outpace EPA’s current proposal for the Phase 3 GHG standard. When it comes to protecting public health and the environment, we simply cannot afford to take regulatory approaches that don’t accelerate the market for zero-emission trucks. Yes, states like California are heading in the right direction, but we need strong national standards to bring the necessary scale and pace of progress.

Comparing Heavy-Duty Zero-Emission Vehicle National Market Share Estimates: EPA’s Phase 3 Standard vs ICCT Projections

In nearly every case, EPA’s estimates for zero-emission vehicle adoption from its Phase 3 rule trail market projections. Table adapted from Table II-24 in the Phase 3 proposal and Table A3 in Table A3 of ICCT’s January 2023 study mentioned above.

We need a national 100% zero-emission vehicle sales standard

Despite the positive outlook for zero emission medium- and heavy-duty vehicles uptake, we still have a long way to go, and more work is required to deliver a clean, equitable, and cost-effective freight future.

In its recent study of the state of electric vehicles, BloombergNEF reports that “strong additional measures [are] needed urgently” to get the worldwide medium- and heavy-duty vehicles market on track for 100% zero-emission vehicle sales by 2050. Here in the U.S., I believe–and the research shows–we can and should get to the 100 percent sales mark far sooner.

1 year ago

64

1 year ago

64