The federal minimum wage in the United States would be more than $42 an hour today if it rose at the same rate as the average Wall Street bonus over the past four decades, according to an analysis released Thursday by the Institute for Policy Studies.

Citing newly released data from the New York State Comptroller, IPS noted that the average Wall Street bonus has increased by 1,165% since 1985, not adjusted for inflation.

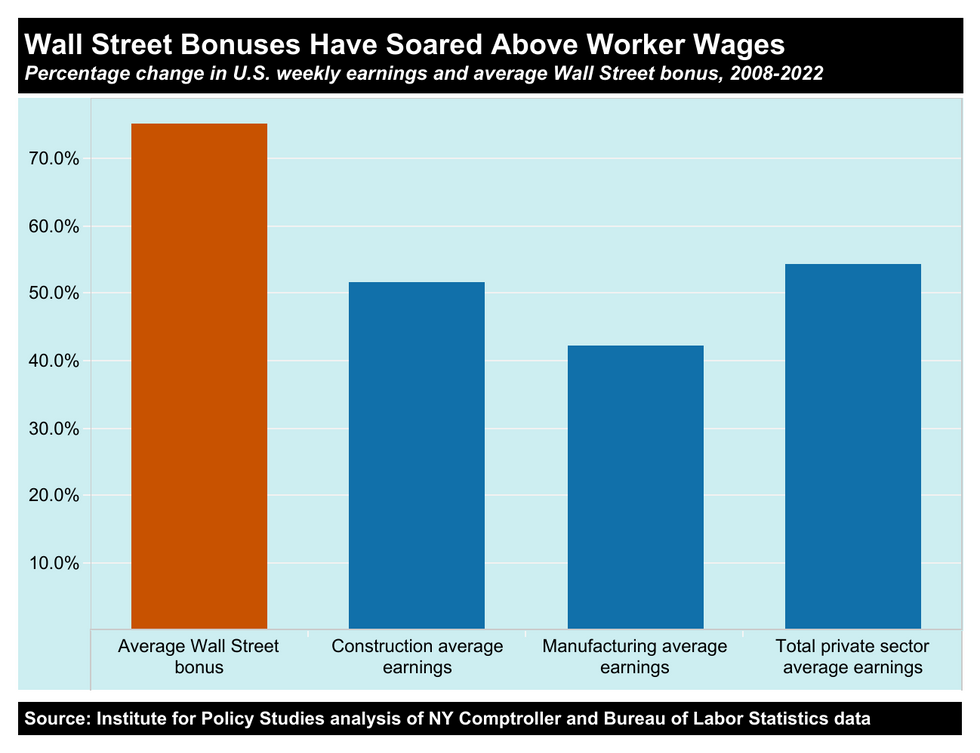

Last year, the average cash bonus paid to Wall Street employees was $176,700—75% higher than in 2008 but slightly lower than the 2021 level of $240,400.

The federal minimum wage, meanwhile, has been completely stagnant since 2009, when it was bumped up to $7.25 from $5.15. While many states and localities have approved substantial pay increases in recent years, 20 states have kept their hourly wage floors at the federal minimum.

Sarah Anderson, director of the Global Economy Project at IPS and the author of the new analysis, wrote Thursday that "average weekly earnings for all U.S. private sector workers increased by only 54.4%" between 2008 and 2022—a significantly slower pace than inequality-fueling Wall Street bonuses.

Anderson argued that there are a number of straightforward steps lawmakers and regulators can take to curb exorbitant Wall Street compensation and bonuses.

In the wake of the 2008 financial crisis, Congress passed several provisions aimed at reining in bankers' compensation as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

But as The American Prospect's David Dayen pointed out last week, "bank regulators hip-pocketed one of those rules that Congress mandated in 2010—the one that would prohibit banker compensation that is specifically tied to taking inappropriate risks."

"The last time there was even a proposed rule on this was nearly seven years ago," Dayen continued. "And in 2018, when Federal Reserve Chair Jerome Powell was asked whether he would abide by Congress' wishes and finish the rule, he blandly replied, 'We tried for many years' and 'we were not able to achieve consensus'—just thumbing his nose at a congressional mandate."

Anderson urged the Biden administration's financial regulators to stop deferring to Wall Street lobbyists and "swiftly—and rigorously—enact the Dodd-Frank Wall Street pay restrictions that were supposed to have been enacted by May 2011."

Any new regulation, Anderson wrote, can and should include "a ban on stock options at Wall Street banks" and mandates requiring Wall Street executives to "set aside significant compensation for 10 years to pay potential misconduct fines."

"If such a regulation had been in place before the [Silicon Valley Bank] collapse," Anderson noted, "top executives would've automatically forfeited this deferred pay to help cover the cost of their recklessness."

1 year ago

49

1 year ago

49